The Integration of Cryptocurrencies in Mobile Payment Apps

The Integration of Cryptocurrencies in Mobile Payment Apps

Why are Cryptocurrencies gaining popularity in mobile payment apps?

Mobile payment apps have revolutionized the way we make transactions and manage our finances. With the rising popularity of cryptocurrencies, it’s no surprise that these digital currencies are now finding their way into mobile payment apps. Here’s why cryptocurrencies are gaining popularity in mobile payment apps:

1. Enhanced Security

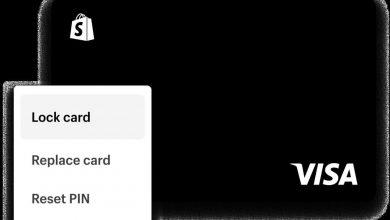

Cryptocurrencies offer enhanced security features due to their decentralized nature and encryption techniques. Unlike traditional payment methods, cryptocurrencies use advanced cryptography, making it difficult for hackers to compromise transactions. Integrating cryptocurrencies into mobile payment apps provides an additional layer of security, giving users peace of mind when making digital transactions.

2. Lower Transaction Fees

Traditional payment methods often come with hefty transaction fees, especially for international transfers. Cryptocurrencies eliminate intermediaries, such as banks or payment processors, reducing transaction costs significantly. By integrating cryptocurrencies into mobile payment apps, users can enjoy lower fees and faster transactions.

3. Global Accessibility

Cryptocurrencies are not bound by geographical limitations or conventional banking systems. This feature makes them ideal for mobile payment apps, as users can make transactions anytime, anywhere, without restrictions. Cryptocurrencies enable cross-border transactions without the need for currency conversions, simplifying transactions for global users.

FAQs about the Integration of Cryptocurrencies in Mobile Payment Apps

Q1: Are cryptocurrencies accepted in mainstream mobile payment apps?

A1: While cryptocurrencies are gaining popularity, their acceptance in mainstream mobile payment apps varies. Some mobile payment apps, like PayPal, have started integrating cryptocurrencies, allowing users to buy, sell, and hold cryptocurrencies within the app. However, not all mobile payment apps support cryptocurrencies yet. It’s essential to check individual app features and updates to know their cryptocurrency integration status.

Q2: How can I use cryptocurrencies in mobile payment apps?

A2: To use cryptocurrencies in mobile payment apps, you’ll need to follow these general steps:

1. Download and install a mobile payment app that supports cryptocurrencies.

2. Create an account and complete the necessary verification process.

3. Link your cryptocurrency wallet to the mobile payment app.

4. Add funds to your cryptocurrency wallet by purchasing or transferring cryptocurrencies.

5. Start using the mobile payment app to make transactions using cryptocurrencies.

Q3: Are there any risks associated with using cryptocurrencies in mobile payment apps?

A3: While cryptocurrencies offer enhanced security features, it’s essential to remain cautious when using them in mobile payment apps. Here are a few risks to consider:

1. Volatility: Cryptocurrency prices can be highly volatile, which means the value of your holdings can fluctuate significantly.

2. Scams and Fraud: Be wary of phishing attempts, fake apps, or fraudulent schemes that may target cryptocurrency users.

3. Technical Issues: Mobile payment apps may face technical glitches or vulnerabilities, so always stay updated with the latest security patches and use reputable apps.

Conclusion

The integration of cryptocurrencies in mobile payment apps opens up new possibilities for secure, low-cost, and global transactions. As cryptocurrencies become more mainstream, more mobile payment apps are expected to offer cryptocurrency support. However, it’s crucial for users to stay informed and exercise caution while using cryptocurrencies in mobile payment apps.

By embracing cryptocurrencies, mobile payment apps are taking a step towards the future of digital transactions, providing users with greater convenience, security, and financial inclusivity.