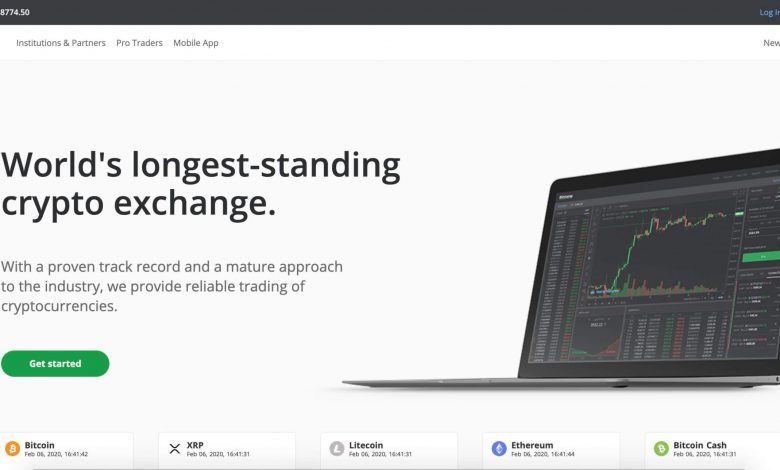

Understanding the Bitstamp Order Book: A Comprehensive Overview

Understanding the Bitstamp Order Book: A Comprehensive Overview

What is a Bitstamp Order Book?

The Bitstamp Order Book is a crucial tool for traders in the cryptocurrency market. It is essentially a real-time display of all buy and sell orders placed on the Bitstamp exchange for a specific cryptocurrency pair. By analyzing the order book, traders can gain insights into market depth, liquidity, and potential price movements.

How Does the Bitstamp Order Book Work?

The Bitstamp order book consists of two main sections: the “Bid” and “Ask” sides. The Bid side displays all buy orders, while the Ask side displays all sell orders. Each order is categorized by price and quantity. The prices are arranged from the highest bid to the lowest ask, creating a list of orders that traders can analyze.

Understanding the Bid Side

The Bid side of the Bitstamp order book lists all buy orders by traders willing to purchase the cryptocurrency at different price levels. The highest bid is displayed at the top, indicating the highest price traders are willing to pay. As you move down the list, the prices decrease, showing the lower bids. Generally, the Bid side represents the demand for the cryptocurrency.

Understanding the Ask Side

The Ask side of the Bitstamp order book displays all sell orders from traders looking to sell their cryptocurrency at various price levels. The lowest ask is shown at the top, representing the minimum price at which sellers are willing to trade. As you move down the list, the prices increase, indicating higher asks. The Ask side signifies the supply of the cryptocurrency.

Why is the Bitstamp Order Book Important?

The Bitstamp order book offers valuable insights for traders. By observing the order book, traders can determine the liquidity of a specific cryptocurrency pair. If the order book shows a significant number of buy and sell orders with tight spreads, it suggests a liquid market, making it easier to buy or sell the cryptocurrency without causing major price fluctuations.

Additionally, the order book helps traders identify support and resistance levels. Large buy orders at certain price levels indicate strong support, indicating that the price is unlikely to fall below that level. Conversely, large sell orders at specific prices indicate resistance, suggesting that the price might struggle to rise above that level.

FAQs

Q: How often is the Bitstamp order book updated?

The Bitstamp order book is updated in real-time. Traders can monitor the most current order book information and react quickly to changes in market conditions.

Q: Can I place orders directly from the Bitstamp order book?

No, the Bitstamp order book is a tool for observing and analyzing market activity. To place orders, traders should use the Bitstamp trading interface.

Q: How can I use the Bitstamp order book in my trading strategy?

The Bitstamp order book can help you make more informed trading decisions. By analyzing the buy and sell orders, you can identify areas of accumulation or distribution, spot potential trend reversals, and determine favorable entry or exit points for your trades.

Q: Are there any other order book metrics besides price and quantity?

Yes, the Bitstamp order book also provides additional metrics like order type (limit or market), timestamp, and order ID. These metrics can be useful for analyzing market behavior and tracking the movement of specific orders.

In Conclusion

The Bitstamp order book is a vital tool for traders to understand the market dynamics and make well-informed trading decisions. By studying the bid and ask sides, observing liquidity, and identifying support/resistance levels, traders can gain a competitive edge in the cryptocurrency market.

Remember, constantly monitor the order book for real-time updates and combine it with other technical and fundamental analysis to make the best trading choices.